CASE STUDY

gowago.ch – Doubling sales with a UX process

Project details

Company: Gowago

Role: Head of UI / UX Design

Platforms: Web

Project details

Company: Gowago

Role: Head of UI / UX Design

Platforms: Web

If you’re reading this, you probably already understand the value and importance of UX. You have likely had to “sell” UX to management as a resource to invest in, to include early in product or service development, and that UX is more than “make the pixels pretty kthx”.

So imagine my intrigue when a trio of startup co-founders – whom just received their first seed-round funding from an investor – decided the first thing to spend money on was a UX practitioner to disrupt the automotive market and learn how people shop for their next car in Switzerland!

Setting the stage

From 5 people on 3 desks to Switzerland’s biggest car leasing marketplace

Before there was even a Gowago office to call home, the three co-founders, a web developer and myself – their new Head of UX, fresh from building design teams and user-centred practices for product development at organisations in Germany, India, and the UK – squeezed onto 3 desks at a startup incubator in downtown Zürich, working frantically to validate our business model, understand our audience, and launch a product for the Swiss market.

Fast forward 6 years – Gowago is onto it’s 5th office, is the biggest car leasing marketplace in the country, by-far the best loved leasing provider (with a 4.8-star customer rating, and NPS score of 50!), profitable for 2 years, and with an annual revenue in the CHF/$/€ 100’s of millions.

Not only does the company’s home look very different, but so does Gowago’s products.

After 3 major pivots, and countless decisions to improve our experiences and understanding of our users, gowago.ch is unrecognisable from our humble beginnings.

But this article isn’t a grand epic of Gowago’s story thus far – If you’d like to hear the Odyssey of Gowago, invite me for a drink or two and I’ll happily recount the tale, or just wait for the film adaptation.

Let’s zoom in on a typical UX project at Gowago instead…

Doubling sales by evolving a product using the UX process

My responsibilities

As Head Of Design and the lead UX on this projects, I was responsible for:

- Gathering user insights and enabling other team members to perform research activities that gather rich, unbiased, and measurable outcomes from our audiences.

- Collaborating with the CPO (Chief Product Officer), company leadership, and cross-departmental stakeholders to align on a problem to work on and hypothesise a solution.

- Propose flows and interfaces that offer the solution in an intuitive way, starting with low-fidelity designs of the most risky parts of the experience, and increasing to high-fidelity mockups as risk was reduced and team alignment increased.

- Built followup research proposals and lead a team of 4 to validate our assumptions, test the project hypothesise, and synthesise our findings. The findings and outcomes from this next iterations of our core products were shared across the company, with opportunities to further evolve.

My responsibilities

As Head Of Design and the lead UX on this projects, I was responsible for:

- Gathering user insights and enabling other team members to perform research activities that gather rich, unbiased, and measurable outcomes from our audiences.

- Collaborating with the CPO (Chief Product Officer), company leadership, and cross-departmental stakeholders to align on a problem to work on and hypothesise a solution.

- Propose flows and interfaces that offer the solution in an intuitive way, starting with low-fidelity designs of the most risky parts of the experience, and increasing to high-fidelity mockups as risk was reduced and team alignment increased.

- Built followup research proposals and lead a team of 4 to validate our assumptions, test the project hypothesise, and synthesise our findings. The findings and outcomes from this next iterations of our core products were shared across the company, with opportunities to further evolve.

Project summary

Project summary

"tl;dr – Can Patrick perform a UX process?"

Discover

We discovered through customer feedback that our flagship product – a financial product where everything needed for owning a car (lease, insurance, tyres, servicing, taxes, etc.) is included in one monthly product – didn’t meet the needs for some of our target audience.

Understand

The scale of the problem for our existing audience, and the opportunity to access different audiences by evolving the product to meet more user needs was measured using quantitative and qualitative research.

Understand

The scale of the problem for our existing audience, and the opportunity to access different audiences by evolving the product to meet more user needs was measured using quantitative and qualitative research.

Product ideation

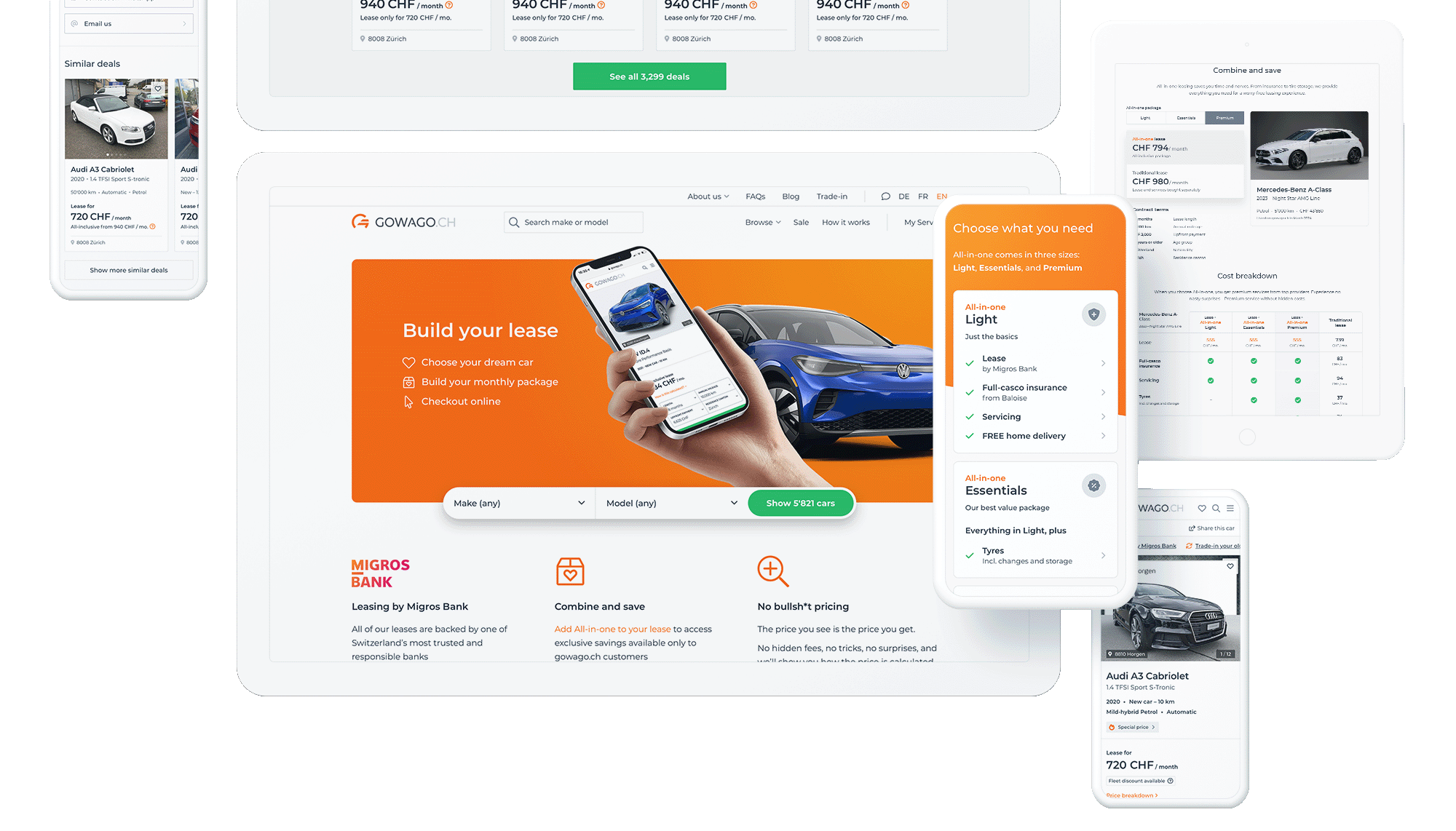

Product ideation and a service design initiatives resulted in new versions of our existing product (All-in-one Premium, Essentials, and Light) using our new understandings of our audience’s needs, the business opportunities available, and our technical and operational capabilities.

Product ideation

Product ideation and a service design initiatives resulted in new versions of our existing product (All-in-one Premium, Essentials, and Light) using our new understandings of our audience’s needs, the business opportunities available, and our technical and operational capabilities.

UX vision

UX practices were used to ideate, propose, and validate an experience and interface that visitors to gowago.ch would find intuitive when learning about our unique financial products, comparing the options and proceeding with a purchase.

Validation

Validation of product-market-fit, usability, and further understanding of our users’ decision making during their car buying journey over the following months confirmed our hypothesis that more flexibility when choosing a financial package both met user’s needs and doubled the number sales. Through the validation activities, we were also able to learn about other obstacles that users encountered during their journey, which lead to an even bigger UX transformation of our digital products later that year.

The longer version

The longer version

The longer version

Mapping the project

Out comes every UX and Agile team’s favourite two favourite diagrams:

Mapping the project

Out comes every UX and Agile team’s favourite two favourite diagrams:

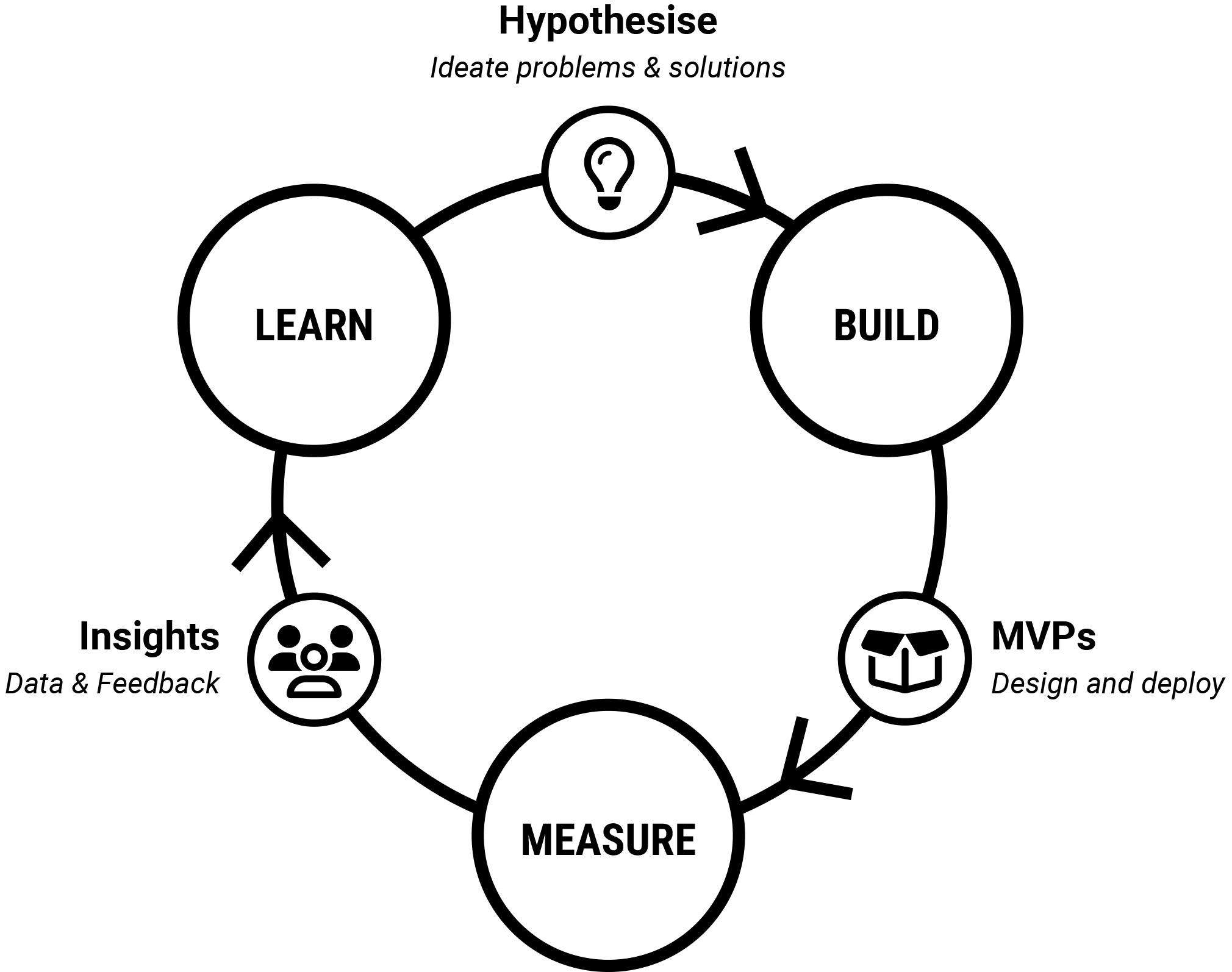

The “Lean Loop”

Also known by the “Build-Measure-Learn Feedback Loop” if you prefer to read circles as a sentence.

The “Lean Loop”

Also known by the “Build-Measure-Learn Feedback Loop” if you prefer to read circles as a sentence.

Mapping the project

Out comes every UX and Agile team’s favourite two favourite diagrams:

The “Lean Loop”

Also known by the “Build-Measure-Learn Feedback Loop” if you prefer to read circles as a sentence.

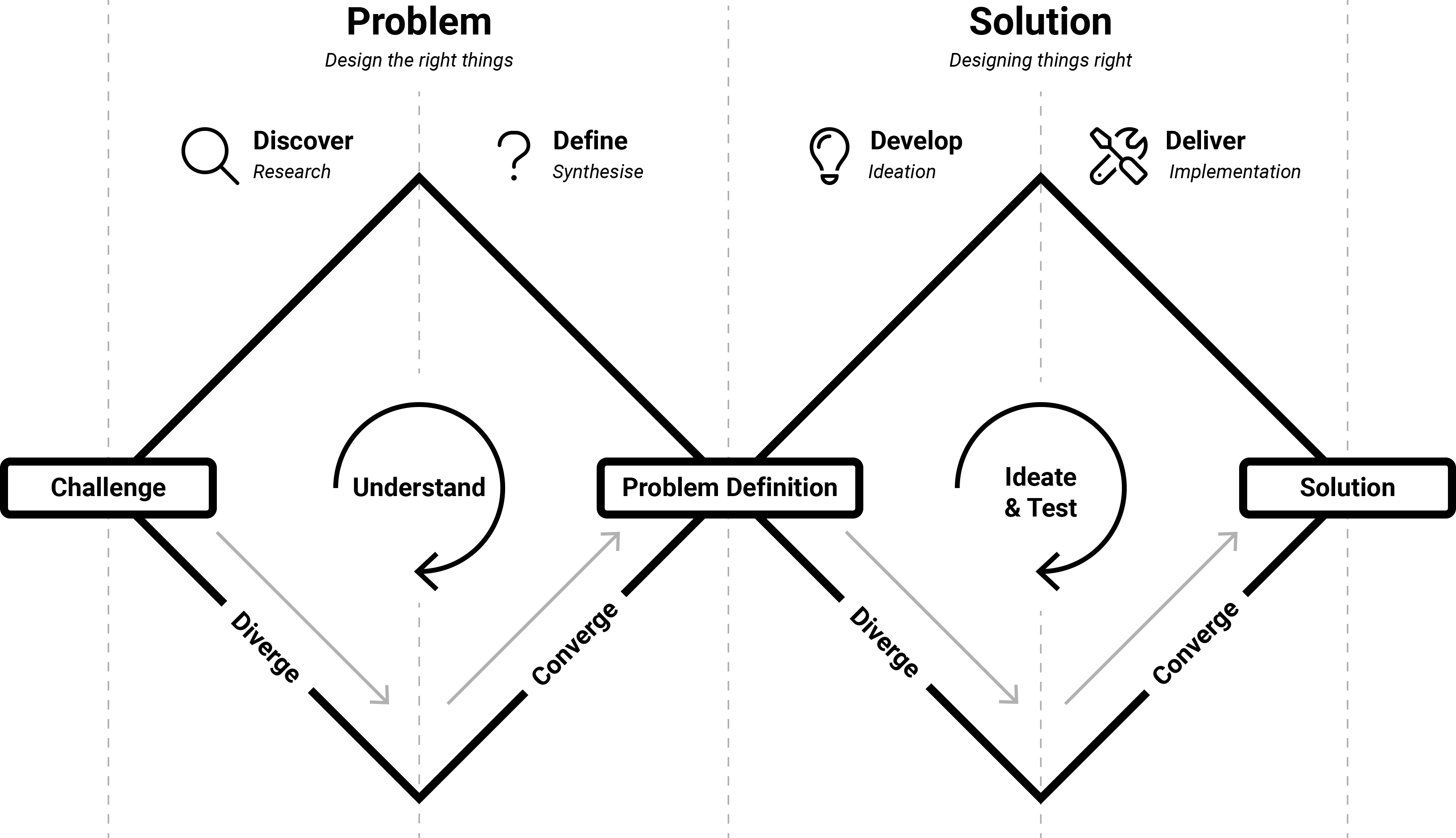

The “Double Diamond” framework

If a UX portfolio doesn’t include a Double Diamond diagram is it truly a UX portfolio?

The “Double Diamond” framework

If a UX portfolio doesn’t include a Double Diamond diagram is it truly a UX portfolio?

The Challenge

Two years earlier, Gowago pivoted away from a reverse-marketplace lead generation platform (where dealerships would compete to fulfil a customer’s order) to become an all-inclusive leasing provider with a product called “All-in-one leasing”.

A year after that, Gowago started offering leasing without All-in-one, fixed prices, and a 100% online car buying journey. Finally there was a place in Switzerland where the price you saw online was the price you got, where you could order the car 100% online, and get everything needed for the car besides the fuel in a single monthly price.

Gowago had Built-Measured-Learned it’s way into disrupting the automotive market in Switzerland by learning about opportunities to offer new innovative solutions, improving it’s product offerings, and reaching bigger audiences.

But our sales and customer success teams were reporting to the Product and UX teams that there were still people who wanted ‘some’ of our all-inclusive leasing product, but not everything listed on the inclusions.

The challenge had been set.

Understanding the Problem

We needed to know:

- What’s getting in the way of people ordering our all-inclusive leasing product?

- What don’t we know about the purchasing journey?

- If we were to change our products, what would be the impact?

We gathered findings from previous interviews with users, performed cross-departmental fact-finding to learn what our customer-facing teams hear from customers during car buying journey, and ideated ways we could learn about barriers in purchasing our current products.

What we discovered at this stage was:

- Of the people we’ve talked to previously, rarely does anyone consider more than the price of a lease when car shopping.

Is that true for the people who visit our website that don’t talk to? - Potential customers often report they’d be interested in an All-in-one package, but certain inclusions were barriers to them.

Which ones and why? - Because All-in-one is unique in the market, learning about the product requires a lot of investment from users. Much of the user’s attention is directed to educating about a product that doesn’t conform to any of their existing mental models.

What parts are difficult to understand, and where do users disengage?

Defining the Opportunity

Through user interviews, data on how people engage with existing features that educate users about our products, and a wealth of knowledge from customer feedback, it was clear that All-in-one’s all-or-nothing approach was a barrier for users.

If Gowago was to offer alternatives to an all-inclusive lease, what would address the biggest audiences and fix their biggest frustrations?

The unspoken messiness of “The Process”

UX portfolios tell the hero’s journey in a linear format, yet everyone knows the UX process is never so straightforward.

Case studies are “meant” to follow Learn → Define → Build → Measure → Iterate story beats, but that never reflects reality.

This project was no different. We were able to build hypothesise on how to evolve our products based on research in the ‘Discover’ phase of the project, but as we moved into the ideation and building stages we discovered that we still needed better insights into when people considered additional services for their car.

We needed to gather further research.

Further Research

We needed a quantitive data, so we launched two surveys: one which recruited from our website and one which recruited from an external user testing agency, so that we could compare the audiences of people already being attracted to gowago.ch and the audiences we’d so far failed to reach.

By comparing the 157 participants from our website to the 154 participants who had no previous knowledge of Gowago, we learnt the audiences were virtually identical in their opinions and frustrations. Both shared the same frustrations in the same order of severity when buying their next car, both ranked our USPs in the same order of important, and both found organising the same inclusions (such as purchasing insurance) equally annoying.

Gowago was attracting the right people. Not just a subset of car buyers.

The Survey

Test participants were asked to complete an unmoderated survey that explored their demographics, car purchasing choices to identify if they were the target audience for our research.

As test particpants were incentivised with vouchers, screening questions were used to ensure we were gathering insights from people who would be eligible for a car with Gowago, and likely to shop for their next car in the following months.

Those that passed the screening questions were asked more indepth questions about their priorities, concerns, frustrations, and decision points in their car search.

The Survey

Test participants were asked to complete an unmoderated survey that explored their demographics, car purchasing choices to identify if they were the target audience for our research.

As test particpants were incentivised with vouchers, screening questions were used to ensure we were gathering insights from people who would be eligible for a car with Gowago, and likely to shop for their next car in the following months.

Those that passed the screening questions were asked more indepth questions about their priorities, concerns, frustrations, and decision points in their car search.

The same survey discovered that people generally consider some inclusions when shopping for a car (such as insurance) but others such as tyres and servicing months and years after they’ve started driving it.

The most surprising finding, and the only major difference between the two audiences, was when it came to choosing a package of inclusions.

When presented with a selection of different packages, such as a package including just the leasing contract, or a package including leasing + insurance, etc. 74% of the cohort from our website would choose the all-inclusive package versus a much more even distribution across the options with the audience who had no knowledge of Gowago.

This allowed us to create two new hypothesise:

- There’s an audience of people that could be attracted by packages with fewer inclusions.

- gowago.ch is either really good at converting our current audience into wanting an all-inclusive lease, or we have been attracting an audience already interested in it.

We were going to build new versions of All-in-one.

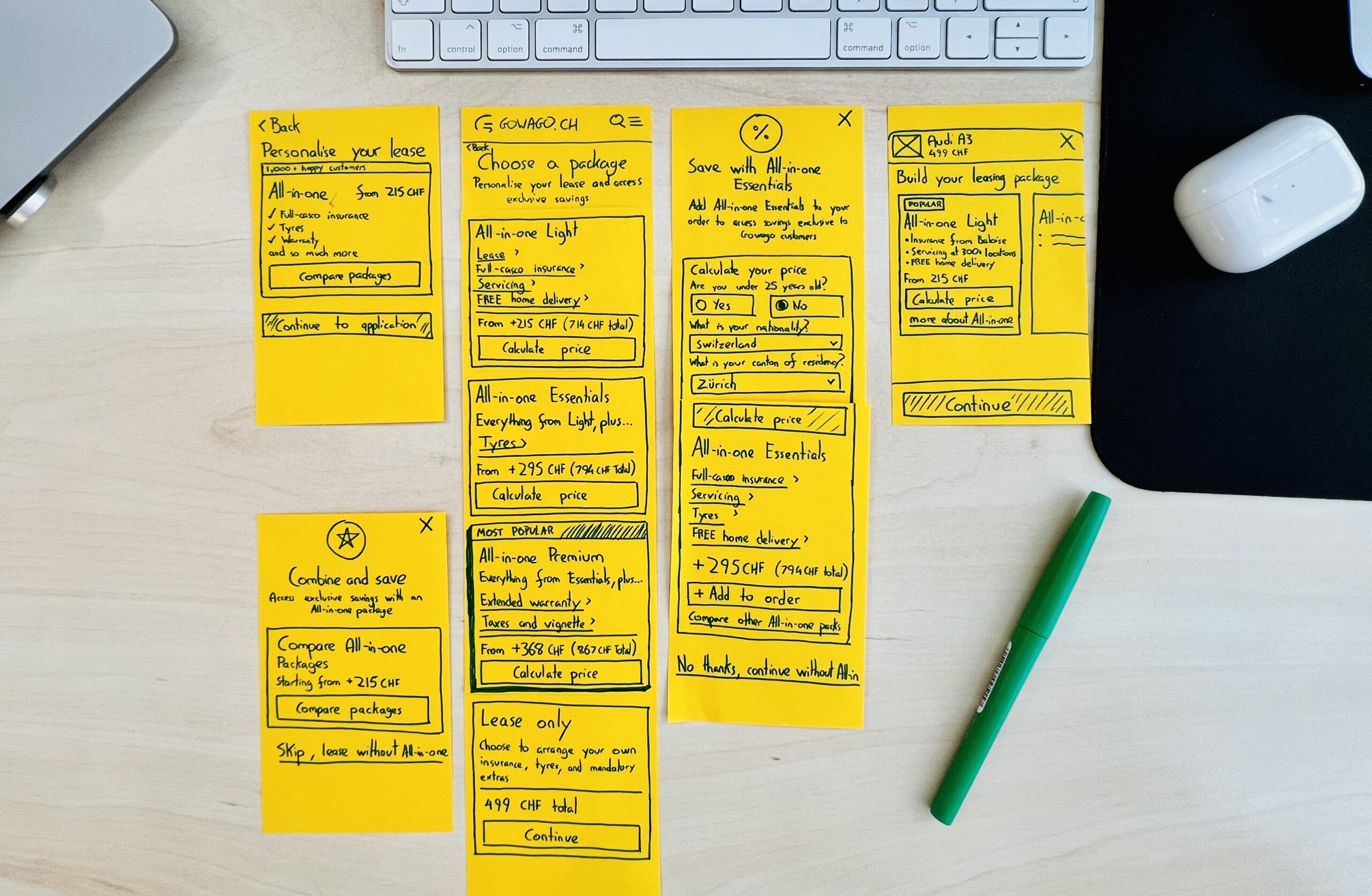

Ideate

When ideating how to evolve All-in-one and the experience of discovering, comparing, and transacting on a package, it was important to consider:

- How could Gowago adjust the product offering in a Lean way to validate it assumptions on our audiences and their needs?

- What operational and technological limitations could impact the proposed solution?

- What other experiences of comparing subscription services could users have previously have, so that we may use mental models they already hold?

Using an MVP (Minimum Viable Product) approach, we identified the fastest way that we could validate our assumptions and hypothesise.

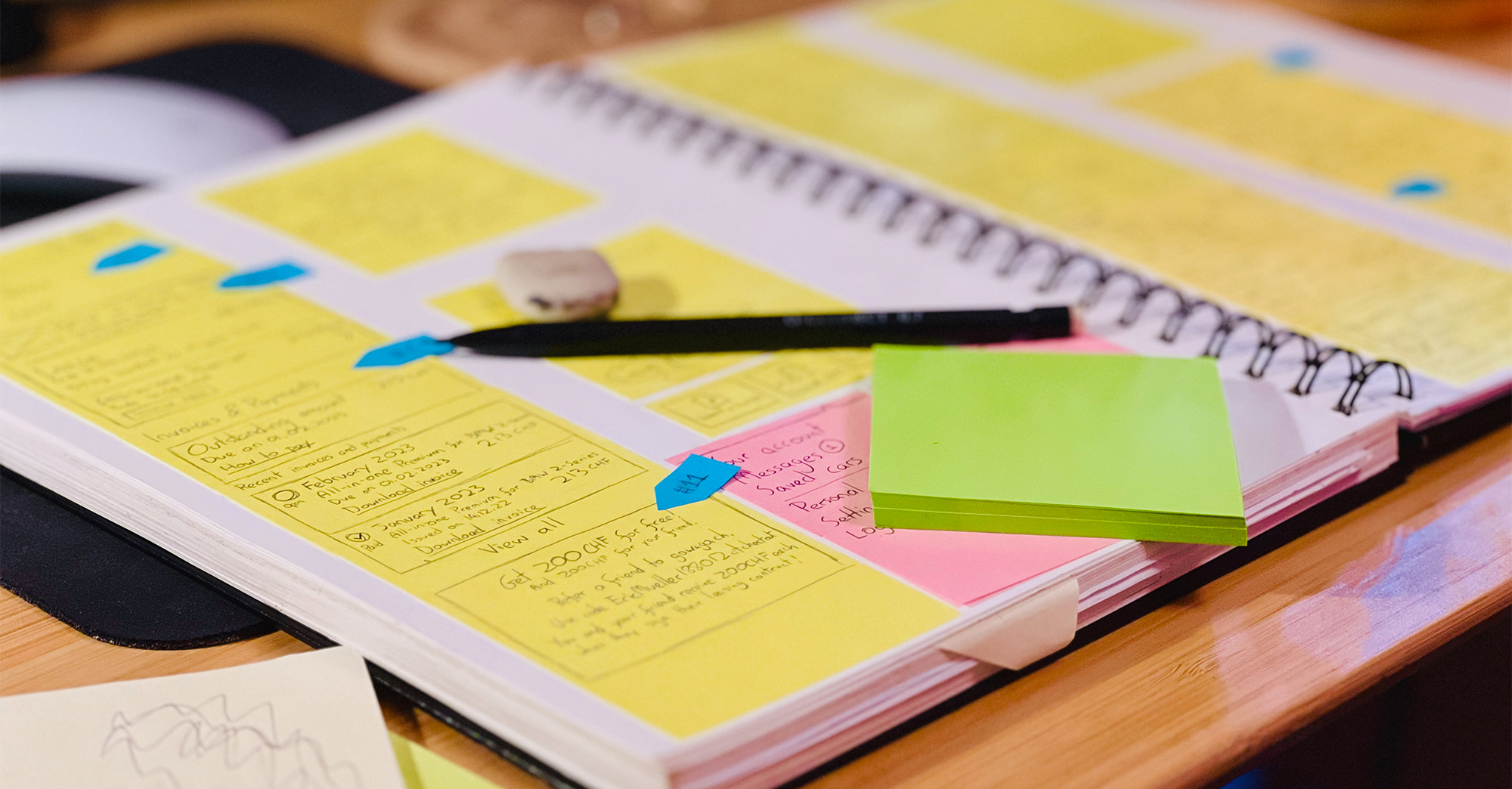

Every idea starts with sketches – They're easy to make, change, edit, trash, throw, and smudge.

By gathering insights into when people compare, what they’d be likely to choose, and the pain points they currently experience, we’d already reduced the risk in offering alternatives to our All-on-one package. Now we wanted to see if the market responded in the same way to what we witnessed in our research.

From a UX perspective, we needed to know how people might compare between packages, and at what point during their journey.

A Lean approach meant employing the least effort to learn about the riskiest parts of this new journey. Therefore, an emphasis was put on cutting features that no longer conformed to the new journey instead of replacing every one with new and unproven features. Guiding users to the most valuable information at the right times, and setting up ways to gather insights on these crucial new parts of the experience.

We were learning where our experience needed to change, which later lead to an audit of features that needed adapting.

Designing

Everything starts with pencil on paper. It’s the fastest, cheapest, and lowest-fidelity way to align the delivery team and stakeholders from the beginning of the UI design phase. Ideas can flow fast and loose, disregarded or refined in a matter of minutes, emphasising on going broad before converging. (The Double Diamond process is diamonds all the way down).

5 user interface ideas explored in less than an hour

A selection of UI's designed to help visitors discover, understand, and compare the new All-in-one packages.

Outcomes and Validation

With the previous year of data as a ‘baseline’ for which we could compare performance to, we launched All-in-one Packages that offered users a choice of inclusions, rather than the previous all-or-nothing iteration.

With keen eyes on key metrics such as visitor-to-lead conversion, bounce rate, and engagement with features related to All-in-one, we were ready to revert to the previous version of All-in-one should we witness anything alarming.

Because we had high confidence that the new packages would meet audience needs through our insights earlier in the project, any dramatic reduction in performance could have been attributed to changes in the experience.

Something interesting happened: More people were choosing to get an all-inclusive lease on gowago.ch.

Sales doubled!

Our assumption was that visitors would be more likely to choose a package with few inclusions (Light or Essentials), but instead the vast majority chose Premium – the same version as our previous product with a fancy new name.

This was a great outcome, as our goal is to ultimately sell more All-in-one subscriptions, but we hadn’t anticipated that the majority of the increase would be led by our existing product.

We needed to learn why. Time to talk to some more people.

“Why not A/B test the change?“

[Scene]

Say you’re installed in a seat on a tram commuting through one of Switzerland’s beautiful cities. You admire the medieval vista beyond your light-rail vehicle’s window when a shiny new Audi Q4 e-tron interrupts the view with it's cargo-sized hulk.

…How much would it cost to drive one of those instead of getting a sore rump on this tram’s wooden seats?

Out comes your phone. You Google the car, and traverse your way onto gowago.ch, where you find that same sleek, electric-drive vehicle.

And you can drive it all-in for less than you’re paying for those rentals you make frequently for the obligatory road-trips across Europe for family events and festivities!

All-in-one Essentials would be perfect. You can handle the taxes and do without the extended warranty for a 40 CHF a month saving.

The tram is almost at your stop. You’ll look into this more when you get home.

You’re home, laptop open, back on gowago.ch, and rediscovered the same silver heap of metal wrapped around a lithium-cobalt battery.

…But where’s “All-in-one Essentials”? You can still see it on your phone. You check. It’s the same gowago.ch.

[fin]

Through our own data and research, we know that the majority of visitors to Gowago, switch devices to one with a larger screen as they become more likely to make a large purchase.

The phenomena in user behaviour and psychology that users will be more likely to use a device with a larger screen correlates with the size of the financial decision is well researched and understood, and gowago.ch sells cars; the most expensive thing most people spend money on after their home and fancy cappuccinos.

Without the ability to follow a user across devices (a capability Gowago did not have at the time) A/B testing product offering is virtually impossible, and deeply frustrating to users lucky enough to land on both sizes of the A/B-test-coin-flip.

Followup research

Why were more people choosing our existing product after offering alternatives?

How were people comparing the different products?

By leading a team of 4, we were able to perform user interviews with people recruited using our existing customer cohort, our curated testing pool of volunteers, and directly from our website.

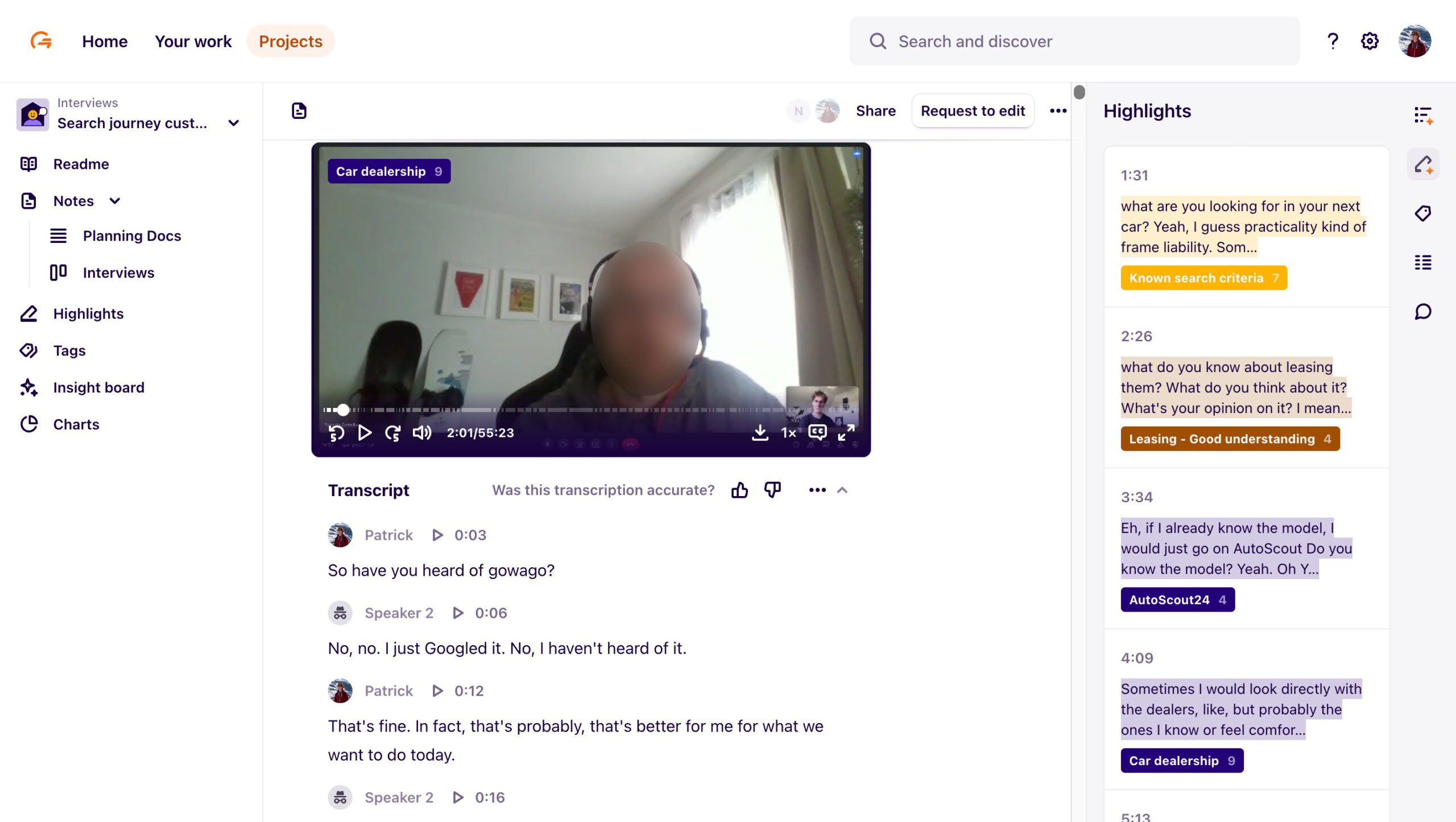

Remote interviews and moderated user testing taking place and analysed in Dovetail, using tagging to discover topics across participants

We discovered that:

- The new packages made the existing all-inclusive package look more convenient and attractive.

- By inviting users to engage in a comparison, they were more likely to explore the inclusions more deeply.

- People with greater knowledge of car ownership were attracted to packages with fewer inclusions.

- Gowago attracts audiences with lesser knowledge of car ownership or people who value convenience.

Through interviewing real people using our products, we learnt about the high learning curve our website demanded from visitors when arriving on our website to find a car with far more than just a lease attached.

This would ultimately lead to new hypothesise on how we might attract audiences interested in leasing, and ramping them up to an All-in-one package later in their journey.

But that is a story for another time…

Project credits

Company: GOWAGO

Selected Works